WSE considers its presence on the capital market as a part of the long-term development strategy which does not rule out issues of shares or bonds in order to finance implemented projects.

Warsaw Stock Exchange is a public company, listed on the WSE Main Market since 9 November 2010. WSE’s new listing followed a public offering where the State Treasury sold 63.82% of shares which conferred, at the date of the offering, 46.86% of votes at the General Meeting. The Company did not increase its capital in the offering.

At the turn of 2011 to 2012, WSE made two public offerings of five-year bonds: series A without a prospectus, addressed to institutional investors, at a total nominal value of PLN 170 million; and series B under a prospectus, addressed to individual investors, at a total nominal value of PLN 75 million. In February 2012, both series were assimilated and introduced into trading on the Catalyst market organised by the WSE Group. The receipts from the bond issue were used in particular to finance the acquisition of the Polish Power Exchange.

WSE considers its presence on the capital market as a part of the long-term development strategy which does not rule out issues of shares or bonds in order to finance implemented projects. Any decisions regarding sources of raised capital will at each time be made on the basis of the cost of capital, the preferred structure of the balance sheet, the target preferred weighted average cost of capital, and the general market situation, while respecting the rights of the existing shareholders and bondholders of the Exchange as well as the rules and best practice followed on the capital market.

Investor Relations

Development, implementation and careful application of the highest standards of investor relations and corporate governance is important to WSE in two ways. First, as Poland’s only securities exchange and organiser of public trading in securities, WSE sets the direction on the capital market in relations with its participants. Therefore, WSE makes all efforts to ensure that its policy of communication with investors and analysts not only complies with the legal provisions applicable to listed companies but also sets the example and provides a model of highest communication standards to be followed by other companies listed on markets operated by WSE.

Second, considering that WSE is a public company, building lasting and professional relations with investors and the capital market is in the Company’s best interest and aims to ensure that:

- the Company can effectively raise capital on the capital market where needed;

- the market price of WSE stock reflects the real value of the Company while ensuring possibly highest liquidity.

In view of the foregoing, the goal of WSE’s investor relations is to maintain open communication with investors, shareholders and bondholders (institutional and individual) in order to continuously build trust in WSE as a leading institution of Poland’s capital market and a public company. The communication should be proactive and respect the fundamental rights of investors to receive current, consistent and true information about the Company.

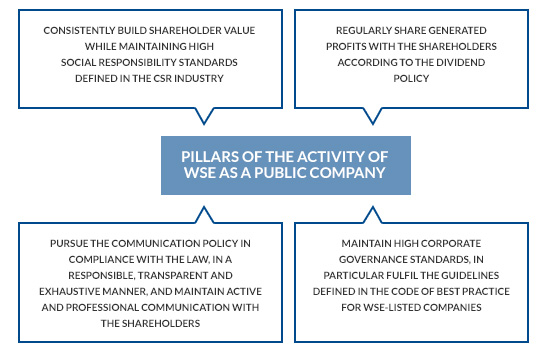

Therefore, WSE’s investor relations and corporate governance activities focus on:

- providing investors with complete and precise data in a concise and accessible format, reflecting the actual financial standing and business position of the Company, as well as information on factors which may significantly impact the present and future value of the Company;

- ensuring equal access to information on the Company for all investors: institutional and individual, Polish and foreign;

- maintaining continuous, honest and interactive dialogue with investors in compliance with the law, including direct meetings and modern telecommunication techniques;

- respecting the rights of shareholders and following the highest standards of corporate governance (including the Code of Best Practice for WSE Listed Companies) and improving them in co-operation with other participants of the Polish capital market;

- making continuous efforts to develop and implement new investor relations tools and practices in line with the global standards.

Figure: Pillars of the activity of WSE as a public company

As part of communication with the market and investors, WSE pursued the following activities in 2013:

- after the end of each quarter, the Management Board of the Exchange presented the financial results of the WSE Group at meetings with investors and capital market analysts and at a teleconference;

- in 2013, the Management Board of the Exchange and the Investor Relations Department held 180 one-on-one and group meetings with representatives of local and international institutional investors;

- in 2013, the Company took part in:

- 7 conferences in Europe (Paris, London, Prague),

- non-deal roadshow in 6 European cities (Vienna, Paris, Frankfurt, London, Edinburgh and Stockholm) and

in the USA (New York and Boston),

- two conferences dedicated to individual investors in Poland;

- in the Investor Relations section of its website www.gpw.pl/relacje_inwestorskie_en, the Company regularly publishes information relevant to investors and shareholders as well as a range of documents describing the activity of WSE;

- the Company regularly responds to questions from investors and shareholders asked by telephone and by e-mail.

WSE won the first place for communication with institutional investors in the category Polish Listed Companies in WIG20 and mWIG40 in the sixth edition of The Golden Website organised by the Association of Listed Companies in 2013.