Share Capital

As at 31 December 2013, and as at the date of preparation of this Report, the share capital of Warsaw Stock Exchange amounts to PLN 41,972,000 (forty one million nine hundred seventy two thousand zlotys) and is divided into 41,972,000 (forty one million nine hundred seventy two thousand) shares with a nominal value of PLN 1 (one) per share. The shares include series A preferred registered shares and series B ordinary bearer shares. Holders of series A preferred registered shares may convert series A shares to series B ordinary bearer shares. The Company’s Articles of Association impose no restrictions on the conversion of registered shares to bearer shares. Conversion of series A preferred registered shares to series B ordinary bearer shares results in a change of the number of votes conferred by each share of the Company from two votes to one vote per share.

In 2013, 42,000 series A registered shares (preferred as to vote) were converted into series B ordinary bearer shares.

In 2013, the Company did not purchase its own shares. The Company has no employees share scheme; accordingly, it has no control system for an employees share scheme.

Shareholders

As at 31 December 2013, and as at the date of preparation of this Report, to the best knowledge of the Company, the State Treasury held 14,688,470 series A registered shares (preferred as to vote) representing 35.00% of total shares and conferring the right to 29,376,940 votes at the General Meeting representing 51.74% of all votes at the General Meeting.

The remaining series A shares (119,000; 0.28% of all shares; 238,000 votes at the General Meeting representing 0.42% of all votes at the General Meeting) were mainly held by brokerage houses and banks.

Shareholding structure of Warsaw Stock Exchange

|

As at 31 December 2013 and as at the date of preparation of this Report | ||||

|---|---|---|---|---|

| Number of shares | % share in the number of shares | Number of votes | % share in the number of votes | |

| State Treasury of the Republic of Poland | 14 688 470 | 35.00% | 29 376 940 | 51.74% |

| Others – preferred shares | 119 000 | 0.28% | 238 000 | 0.42% |

| Others – bearer shares | 27 164 530 | 64.72% | 27 164 530 | 47.84% |

| Total | 41 972 000 | 100.00% | 56 779 470 | 100.00% |

Source: WSE

As at 31 December 2013, and as at the date of preparation of this Report, to the Company’s best knowledge, no shareholder other than the State Treasury held directly or indirectly at least 5% of the overall number of votes at the General Meeting of Warsaw Stock Exchange.

Amongst all persons managing and supervising the Company, its shares bought in public offering (25 shares) were held as at the balance-sheet date by:

- Dariusz Kułakowski, Member of the Management Board,

- Wiesław Rozłucki, Chairman of the Supervisory Board.

According to the Company’s best knowledge, persons currently managing and supervising the Company do not hold shares in its subsidiaries or associates.

Share Listing on WSE

WSE was newly listed on Warsaw Stock Exchange on 9 November 2010. The share price at the closing of the first trading day was PLN 54, i.e., 25.6% more than the share allocation price for retail investors in the IPO (PLN 43) and 17.4% more than the price in the institutional tranche (PLN 46). The Company’s shares are listed on the WSE main market in the continuous trading system. As at 31 December 2013, 27,164,530 series B bearer shares (64.72% of all shares), which give the right to exercise 27, 164,530 votes (47.84% of the total vote at the General Meeting), were introduced to trading on WSE.

The Company’s shares are part of the following indices calculated by WSE:

- WIG and WIG-PL – broad market indices (since the trading day of 13 November 2010)

- mWIG40, the WSE mid-cap index (since the trading day of 19 March 2011)

- WIGdiv, the WSE high-dividend index (since the trading day of 17 December 2011)

- RESPECT, the corporate social responsibility index CSR (since the trading day of 23 December 2013)

In addition, WSE’s shares participate in a range of emerging market mid-cap and small-cap indices as well as exchange operator indices calculated by specialty providers of world recognition.

In 2013:

- the WSE share price rose by 6.8% from PLN 38.87 at the closing of the last trading day in 2012 to PLN 41.5 at the end of 2013;

- the record date of the dividend from the 2012 profit at PLN 0.78 per share was 12 July;

- the average WSE share closing price was PLN 40.1 per share in 2013, which was 7.1% (PLN 2.65) more than in 2012;

- the WSE share price ranged from PLN 35.15 (5 September) to PLN 44.74 (30 October);

- the average daily volume of session trading was 60,008 shares;

- the average daily value of session trading was PLN 2.4 million;

- the velocity ratio of WSE shares (annual turnover to company capitalization) was 34%;

- the Company’s capitalization was PLN 1.74 billion at the end of 2013 compared to PLN 1.63 billion a year earlier.

WSE share price in 2013

WSE share price from new listing to the end of January 2014

Issue of WSE Bonds, Application of Cash Raised in the Issue

In December 2011, the Company issued 1,700,000 series A bearer bonds with a total nominal value of PLN 170 million. In February 2012, the Company issued 750,000 series B bearer bonds with a total nominal value of PLN 75 million.

The purpose of the series A and B bond issue with a total value of PLN 245 million was to finance WSE projects including institutional consolidation on the exchange commodities market and expansion of the range of products available for investors on that market, as well as technology projects in financial markets and commodity markets. Receipts from the issue of series A and B WSE bonds were largely used to acquire shares of the Polish Power Exchange (“PolPX”):

- on 24 February 2012, shares representing 80.33% of the share capital, which give the right to exercise the same proportion of votes at the general meeting of PolPX; transaction value: PLN 179.4 million;

- on 29 February 2012, shares representing 7.67% of the share capital, which give the right to exercise the same proportion of votes at the general meeting of PolPX, on terms similar to those of the above transaction;

- in subsequent months, WSE gradually increased its stake in PolPX: it stood at 91.34% as at 30 June 2012; 98.17% as at 30 September 2012; and reached 100% in December 2012.

As at the balance-sheet date of 31 December 2013, and as at the date of preparation of this Report, WSE is the sole shareholder of PolPX. WSE paid PLN 213.9 million for 97.67% of PolPX shares acquired in 2012, which implies the company’s aggregate valuation of PLN 219 million.

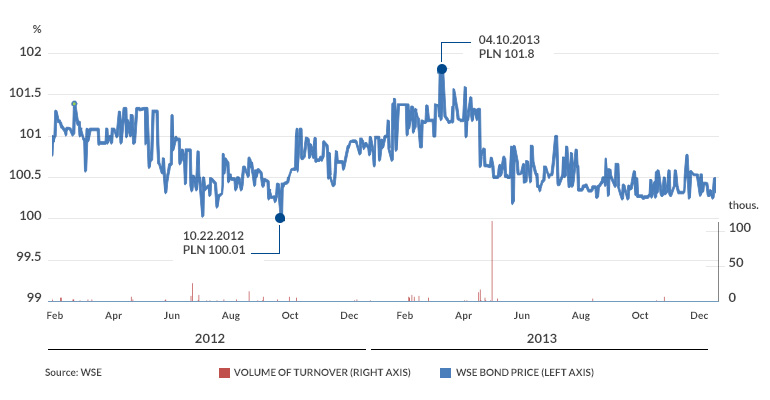

WSE bond listing on Catalyst

WSE bonds are listed on the bond market Catalyst (on the WSE regulated market and in the BondSpot alternative trading system) since February 2012.

WSE bonds are floating rate unsecured notes. Interest is fixed within the interest period at WIBOR 6M plus a margin of 117 basis points.

The table below presents interest rates in interest periods as well as the amount of interest.

Interest rate and amount of interest on WSE bonds

| Interest period number | Period | Interest paid (per bond) | Interest rate in the interest period |

|---|---|---|---|

| I | 23/12/2011 (A) 15/02/2011 (B) - 30/06/2012 | 3.21 | 6.17% |

| II | 30/06/2012 - 31/12/2012 | 3.18 | 6.31% |

| III | 31/12/2012 - 30/06/2013 | 2.62 | 5.29% |

| IV | 30/06/2013 - 31/12/2013 | 1.95 | 3.87% |

| V | 31/12/2013 - 30/06/2014 | 1.93[1] | 3.89% |

* The interest will be paid on 30 June 2014.

WSE bond price

Agreements in Respect of WSE Shares and Bonds

As at the date of preparation of this Report, the Company has no information as to agreements (including post-balance sheet date agreements) which could result in any changes in the future in respect of the proportions in shares or bonds held by the existing shareholders and bondholders.