According to WFE, NYSE Euronext with a global market share of 28.0% was the world’s biggest exchange by capitalisation of the equities market at the end of 2013.

Size of the exchange sector

The table below presents statistics of the value of trading generated world-wide by exchanges associated in WFE (World Federation of Exchanges), capitalisation, and capital raised by issuers from issues of securities which were subsequently admitted to exchange trading.

| US$ billion1 | As at / For the year ended 31 December | |||||

|---|---|---|---|---|---|---|

| 2013 | 2012 | 2011 | 2010 | 2009 | CAGR 2009-2013 | |

| Stock exchange sector | ||||||

| Value of trading in shares (order book, for the period) | 54 700 | 48 925 | 63 080 | 63 091 | 62 004 | -3.1% |

| Capitalisation (domestic companies, as at the end of the period) | 64 195 | 56 006 | 47 400 | 54 884 | 47 788 | 7.7% |

| Capital raised by issuers (IPOs and SPOs, for the period) | 534 | 566 | 396 | 1 003 | 960 | - |

| WSE | ||||||

| Value of trading (order book, for the period) | 69.9 | 58.2 | 85.6 | 69.0 | 54.6 | 6.4% |

| Capitalisation (domestic companies, as at the end of the period) | 205.4 | 177.4 | 138.2 | 190.7 | 151.0 |

8.0% |

| Capital raised by issuers (IPOs and SPOs, for the period) | 2.7 | 2.5 | 4.0 | 12.4 | 8.5 | - |

[1] Source: WFE (World Federation of Exchanges); until 2011, data include WSE; since 2013 WSE is no longer WFE member.

According to WFE, NYSE Euronext with a global market share of 28.0% was the world’s biggest exchange by capitalisation of the equities market at the end of 2013, followed by NASDAQ OMX and the Tokyo Stock Exchange with a global market share of 9.5% and 7.1% respectively. The same exchanges were the world’s top exchanges by value of trading in shares. In 2013, NYSE Euronext generated the biggest turnover in shares (25% market share), followed by NASDAQ OMX (17.5% market share) and Tokyo Stock Exchange (11.5% market share).

Main trends on the capital markets

- Consolidations of exchanges through mergers, acquisitions and strategic alliances of the biggest exchanges in Europe and world-wide (merger of NYSE and Euronext in 2006; acquisition of OMX in Scandinavia by NASDAQ in 2007; acquisition of Borsa Italiana by LSE in 2007; merger of Russian exchanges MICEX and RTS in 2011; acquisition of NYSE Euronext by ICE in 2013),

- Addition of new products and services to the offer of exchanges by introducing new types of financial instruments to trading including derivatives, participation units in investment funds and mutual funds, and debt instruments;

- Diversification of sources of revenue of exchanges by developing new business models and establishing alternative trading systems as platforms of financing and trading for small and medium-sized enterprises;

- Development of new technologies and growing popularity of MTFs which are very competitive to traditional exchanges owing to low costs and superior trading speed, as well as mergers of MTFs (merger of Chi-X Europe and BATS Global Markets in 2011) and acquisition of regulated exchange status by MTFs (BATS Chi-X Europe in May 2013);

- Development of new business lines (distribution of market data, IT services, trade in exchange commodities), vertical integration of the exchange business and development of post-trading services;

- Growing importance of legal regulations impacting the operation of exchanges both in Europe and in the USA.

Competitive position of WSE

WSE is one of the fastest growing exchanges among European regulated markets and alternative markets regulated by exchanges, and the biggest national exchange in the region of Central and Eastern Europe. At the end of 2013, WSE listed the highest number of companies among all exchanges in the region of Central and Eastern Europe. WSE also had the biggest capitalisation and the highest turnover in shares in 2013 among the CEE exchanges. The Company competes with other European regulated markets and alternative markets regulated by exchanges in attracting foreign issuers; WSE focuses its marketing, regulatory and infrastructure activities on companies from the region of Central and Eastern Europe where, in the opinion of the Company, it has a substantial advantage over other competing exchanges. The competitive position of WSE versus other exchanges is determined by factors including the quality of IT systems which impact the speed, certainty and quality of trade execution, the size of the market, the number of listed companies, a strong sector of institutional investors, and the credibility and quality of regulation.

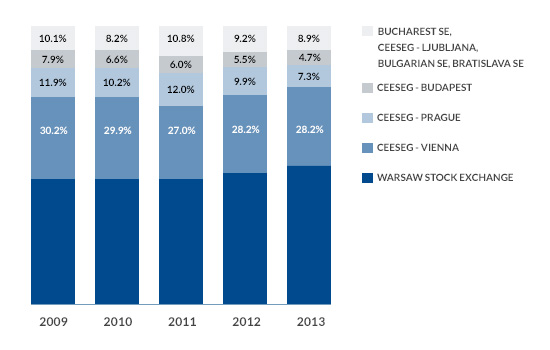

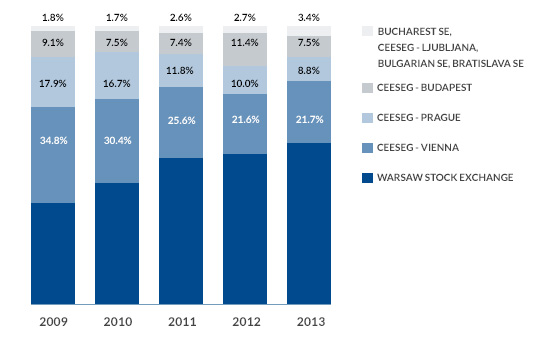

As at 31 December 2013, WSE was the leader in the region of Central and Eastern Europe as measured by the capitalisation of listed companies and the value of turnover in shares. WSE’s share in equities trading in the region increased from 54.3% in 2012 to 58.5% in 2013 while the capitalisation of companies listed on WSE represented 47.2% of the capitalisation of shares in the region in 2012 and 49.1% in 2013.

Share of exchanges in the capitalisation of shares in Central and Eastern Europe

Source: FESE (capitalisation of domestic companies and foreign companies for which the above exchanges are the single-listing market)

Share of exchanges in turnover in shares in Central and Eastern Europe

Source: Thomson Reuters (turnover in shares on the order book)

Currently, WSE is a leading European exchange by the volume of trading in derivatives. The major part of trading in derivatives on the WSE has so far been generated by WIG20 index futures: WSE ranked fifth among European exchanges by the volume of trading in share index futures in 2013. WSE also offers trade in a range of other derivatives including WIG20 options, mWIG40 futures, single-stock futures, currency futures, interest rate futures, as well as WIG20 index participation units.

Multilateral Trading Facilities (MTF)

The organised market includes regulated markets as well as multilateral trading facilities (MTF), which are mainly addressed to institutional investors and offer trade in shares at a very high trading speed and low trading fees. MTFs are usually operated by investment firms (banks, brokerage houses) or stock exchanges.

There are two main categories of MTFs. One category are those MTFs which offer secondary trade in liquid European stocks in a public order book and compete with exchanges by the cost of trading and the speed and efficiency of the trading system. These include BATS Chi-X Europe (transformed into an exchange in 2013) and Turquoise (of which LSE is its majority shareholder), as well as Aquis Exchange (of which WSE is a shareholder). No such MTF has yet offered trade in Polish stocks. The other category are “dark pools”: trading facilities which allow institutional clients and brokers to trade in large orders, to close trade at reference prices generated in other systems, or to close previously negotiated trades.

Markets regulated by exchanges

Alternative trading systems organised by exchanges typically have less strict requirements for listed companies than those imposed by regulated markets. Companies listed in alternative trading systems organised by exchanges are usually smaller than companies listed on regulated markets and typically have been in business for a shorter period of time. AIM in London is the leader among alternative trading systems organised by exchanges: it listed 1,087 companies at a capitalisation of EUR 76 billion as at the end of 2013. NewConnect, the market opened by WSE in August 2007, is the fastest growing such market in Europe as measured by the number of listed companies.

European energy exchanges

The Polish Power Exchange (PolPX), a member of the WSE Group, organises the biggest power market in the region of Central and Eastern Europe. The volume of trading on all power markets of the Polish Power Exchange was 176.554 TWh in 2013, equivalent to 108.6% of power generated in Poland and more than 111.8% of total energy consumption.

The European market is dominated by several large exchanges which have a history of consolidation and now decide about strategic directions of the common energy market and its technical solutions. Nord Pool Spot (active in Norway, Sweden, Finland and Denmark) has expanded to the Baltic States (Lithuania, Estonia, Latvia); APX-Endex has expanded to the UK and is now present in the UK, Belgium and the Netherlands; EPEX Spot has expanded to France (it now operates in Germany, France, Switzerland and Austria); these energy exchanges decide about strategic directions and technical solutions.

The importance of smaller exchanges may diminish with the consolidation of the European market, especially where they operate on a local market which is small in terms of statistics and territory. With a very liquid energy market and a good geographic location in Central and Eastern Europe, PolPX can aspire to join the group of leading exchanges.